Trading with Ichimoku Kinko Hyo A Comprehensive Guide

- 22

- Sep

Trading with Ichimoku Kinko Hyo: A Comprehensive Guide

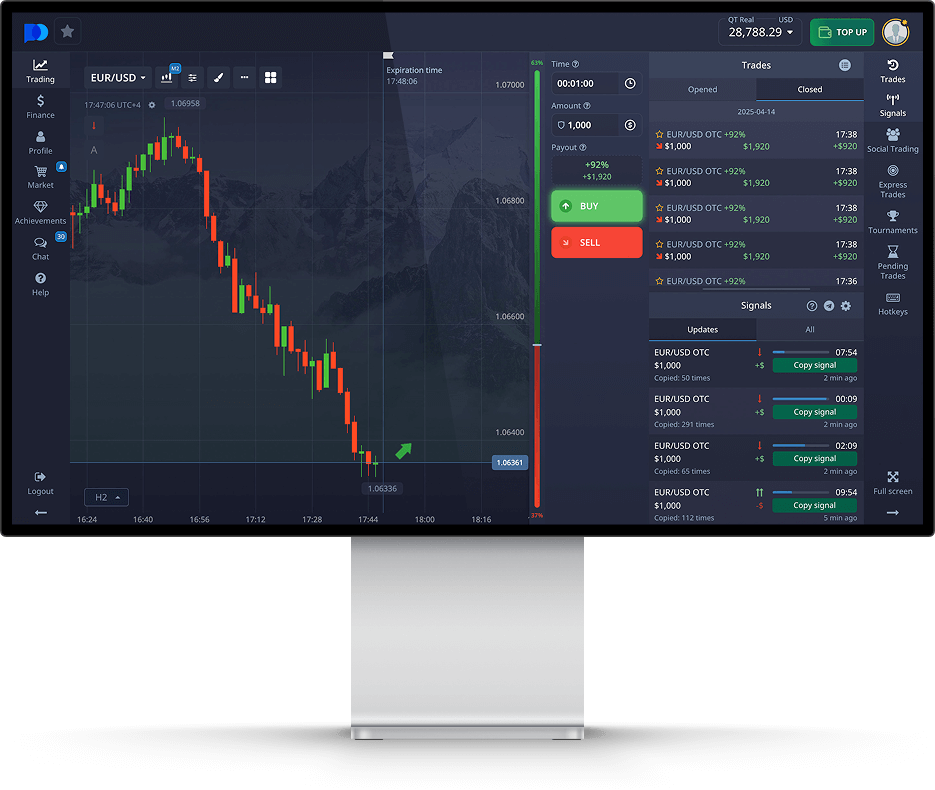

The world of trading is filled with various technical indicators, each offering unique insights into market behavior. One such tool that has gained significant popularity among traders is the Ichimoku Kinko Hyo. The name may sound complex, but once understood, this Japanese indicator provides a wealth of information regarding support and resistance levels, trend direction, and momentum. In this article, we will delve deep into Trading with Ichimoku Kinko Hyo, providing you with a detailed understanding of its components, how to interpret them, and strategies for integrating this powerful tool into your trading arsenal. For a practical guide, consider visiting Trading with Ichimoku Kinko Hyo in Pocket Option https://trading-pocketoption.com/torgovlya-s-pomoshhyu-ichimoku-kinko-hyo-v-terminale-ot-pocket-option/.

Understanding the Components of Ichimoku Kinko Hyo

The Ichimoku system consists of five main components, each contributing to its overall effectiveness:

- Tenkan-sen (Conversion Line): This is calculated by taking the average of the highest high and the lowest low over the last 9 periods. It reflects the short-term trend and is often used as a trigger for buy or sell signals.

- Kijun-sen (Base Line): This line is derived by averaging the highest high and the lowest low over the last 26 periods, serving as a benchmark for identifying significant support or resistance levels.

- Senkou Span A (Leading Span A): This is the average of the Tenkan-sen and Kijun-sen plotted 26 periods into the future, providing a forward-looking resistance or support level.

- Senkou Span B (Leading Span B): Calculated based on the highest high and the lowest low over 52 periods, this line is also projected 26 periods into the future and helps to determine market trends.

- Chikou Span (Lagging Span): Representing the closing price plotted 26 periods into the past, it is used to confirm trends based on the current price action.

Interpreting the Ichimoku Cloud

One of the most distinctive features of the Ichimoku system is the “cloud” formed by the two Senkou Span lines (A and B). The area between these lines is known as the “Kumo” or cloud. Here’s how to interpret it:

- Cloud Thickness: A thicker cloud indicates stronger support or resistance, while a thinner cloud suggests weaker levels.

- Direction of the Cloud: If Span A is above Span B, the market is considered bullish, while a bearish trend is indicated when Span B is above Span A.

- Price Position: Prices above the cloud suggest a bullish trend, while prices below the cloud indicate a bearish trend. When prices are within the cloud, it signals a range-bound or indecisive market condition.

Setting Up the Ichimoku Indicator on Your Chart

To start using the Ichimoku Kinko Hyo, you need to configure your trading platform. Most platforms, including MetaTrader and TradingView, have a built-in Ichimoku indicator. Here’s how to set it up:

- Open your charting platform and select the asset you wish to trade.

- Locate the indicators section and choose the Ichimoku Kinko Hyo from the list.

- Make sure the default settings (9, 26, 52) are applied, as they are commonly used by traders.

- Adjust colors and styles as preferred for improved visibility.

Developing Your Trading Strategy with Ichimoku

When developing a trading strategy using the Ichimoku Kinko Hyo, it’s important to look for signals generated by the various components of the indicator. Here are some strategies to consider:

1. Crossover Strategy

The crossover of the Tenkan-sen and Kijun-sen is a common signal. When the Tenkan-sen crosses above the Kijun-sen, it can indicate a buy signal, while a cross below can suggest a sell signal. This strategy works best when confirmed by the position of the price relative to the cloud.

2. Trend Following

Utilize the cloud’s direction to determine the overall trend. If the price is above the cloud, look for buy signals; if below, focus on sell signals. Combining this with additional indicators can further enhance your probability of success.

3. Support and Resistance Levels

Use the Senkou Span lines as dynamic support and resistance levels. Traders can observe price reactions around these lines to identify potential entry and exit points.

Common Mistakes to Avoid

Despite its effectiveness, traders often make mistakes when using the Ichimoku Kinko Hyo. Here are a few that you should avoid:

- Ignoring the Bigger Picture: Always consider the broader market context rather than relying solely on the Ichimoku signals.

- Overtrading: The Ichimoku system can produce many signals, but not all are valid. It’s important to wait for confirmation before taking a trade.

- Failing to Manage Risk: Always use proper risk management techniques to protect your capital, regardless of how reliable you perceive your signals to be.

Conclusion

Trading with Ichimoku Kinko Hyo can provide traders with a comprehensive view of market conditions. By understanding its components and utilizing them effectively in your trading strategy, you can enhance your trading performance. Take your time to practice and refine your approach, and you may find that this powerful indicator contributes significantly to your success in the financial markets. As you continue to expand your trading toolkit, incorporate various strategies and indicators to best suit your trading style.